What do you think drives stock prices the most? Basic stock fundamentals or investor’s sentiment? Investors of the Chegg, Inc.(NYSE: CHGG) stock would most likely tell you it is the latter, as the stock is currently suffering from heavy bearish sentiments, despite fair fundamentals. The question now is if the stock has finally reached its bottom.

What Has Happened?

Source: Pixabay

That Chegg stock has been through rough times is an understatement. What looked like a mere correction turned into a full-blown dip that escorted the price down by over 70%. Despite fairly strong quarterly figures in the past, the stock responded more to investors sentiment rather than the figures. By the way, Chegg is an educational technology platform that offers various digital services for students.

So What?

In November 2021 when the company released its third quarterly result, the company CEO mentioned how Covid-related issues have lowered the demand for the company’s services, which would, in turn, impact the next quarter. The company then estimated its sales revenue to come at $194 million to $196 million. The stock responded by dipping by 50% on that same day.

Source: Chegg

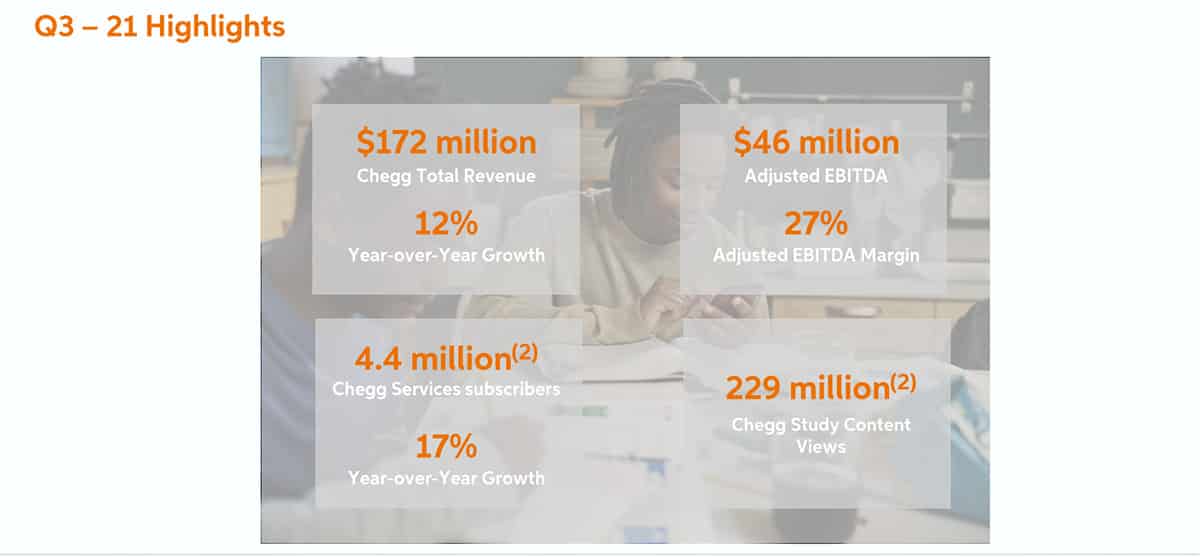

In that same quarter, however, the company had made $171.9 million in revenue, 12% up from what it made around the same time the previous year. Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) rose by 45% to $46.4 million. These figures were not as high as what Chegg investors were used to seeing, though.

What Next?

All hope is not yet lost, at least for the management of educational technology company. It believes “Chegg is in an excellent position to come out of this temporary slowdown stronger than ever.”

Finally, the company estimates its market opportunity to be 102 million. To put this figure into context, Chegg only has 6.6 million services subscribers as we speak.

Technical Analysis

The question on the minds of many investors would be if the CHGG stock has finally bottomed out after the scary dip. CHGG, though, looks to have settled at the $22 – $26 support level. Falling below this level would bring the stock to its lowest price level since 2018.

If CHGG is going to rise, however, this support level seems to be the best place to start. The support level coincides with the downside level the heads-and-shoulders pattern which appeared in previous weeks sentenced the stock to. This same support level has been tested multiple times in the past.

Since there’s no way to tell if there’s more downside to this stock? We advise potential investors to hold for now. And if there’s any bullish challenge, we expect the price to break out of the $44 – $47 resistance level before we pay any serious attention to it again.