The fintech industry has evolved massively, with companies on a constant search for new innovative ways to facilitate financial transactions. But companies in this space are so many that merely staying afloat is enough achievement for many of them. Even the leaders have to fight to hold on to their current customers. On our radar today is Fiserv Inc. (Nasdaq: FISV), one of the leading fintech companies in the US. The question is if Fiserv is worth keeping an eye on.

Source: Pixabay

Fiserv has strategically positioned itself in the fintech market with its three major segments. The first two serve institutions, such as banks and credit unions. The last, and its biggest, serves merchants through what the company calls Clover. Through Clover, Fiserv offers hardware solutions to merchants, facilitating credit card payments for these merchants in their physical stores. Thanks to all three segments, Fiserv has over $1.4 billion customer accounts registered, processing over 12,000 financial transactions every second.

Source: Fiserv

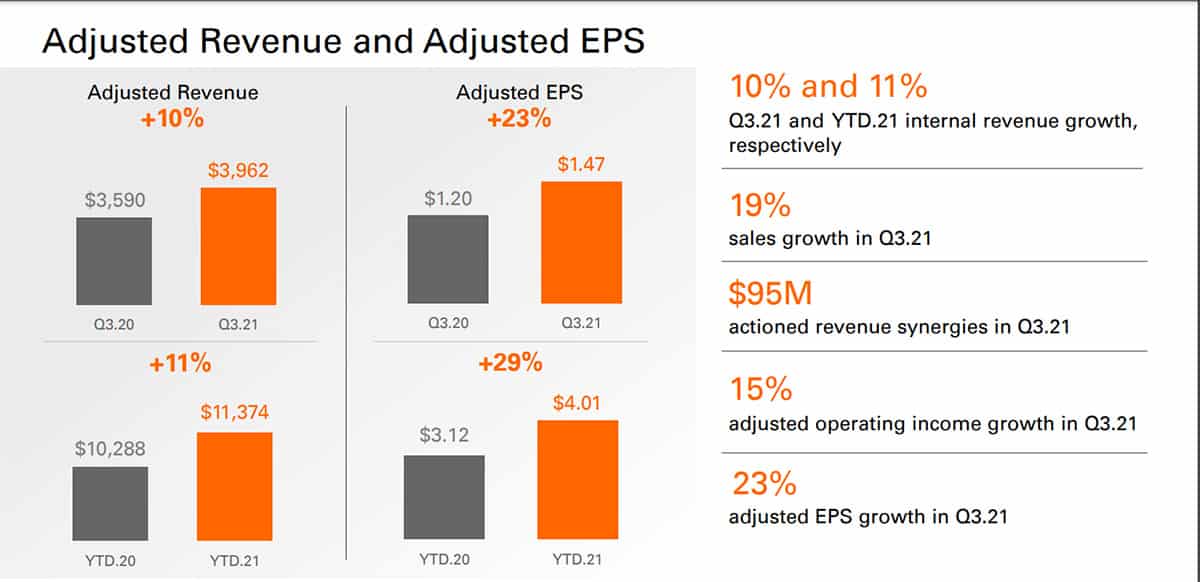

In the quarterly result released for Q3 FY21, Fiserv increased its adjusted revenue year-on-year by 10% to $3.9 billion. Adjusted earnings per share also rose by 23% to $1.47 year-on-year. Sales also grew by 19% in the same quarter. These are fair figures for a company with a $72 billion market cap.

Growth investors like to know what the future might look like for their stock. They’ll be glad to know that Fiserv’s looks exciting. Perhaps, the fintech company’s most exciting innovation is that it allows banks, other fintech establishments, and credit unions to add cryptocurrencies to their services. This way, banks can offer their clients exposure to the booming cryptocurrency market, while also exposing company shareholders to the cryptocurrency industry.

The potential downside to FISV is that the company is in a debt worth about $20 billion as at the end of its latest quarterly result. This may not affect the operations of the company short term, though, as the company had $2.3 billion in free cash YTD as at the end of Q3 FY 2021.

Technical Analysis

FISV has mostly ranged on the weekly timeframe, penduluming between the $90 – $94 support level and the $124 – $128 resistance level. There’s a minor level in between those two levels at $107 – $111, though.

No genuine hope of bullish growth can be nurtured for the stock until it breaks out of the $124 – $128 resistance level, though. Only then can we be sure that the stock is out of the woods of consolidation. Until then, the price may continue to range within the boundaries of the levels.

For potential investors, however, now may be the best time to get in on the stock. Growth investors may hold on to the stock for its growth opportunities, while value investors can smile at the thought that many analysts believe FISV is currently undervalued.