As an investor, before taking on a long-term position, you should always ask yourself “Is there enough upside available or room for the company to grow?“.

After all, investing in a stock means that you’re looking to make money on a directional move, which can only happen if the company grows its market cap.

Now, looking at Apple, which has been in an uninterrupted bull run since early 2000’s, it’s easy to think that there is no more upside available at this point. If that’s you, I challenge you to reconsider. Why?

One word: 5G

Apple has a massive and super loyal crowd of customers. Despite raising their average selling price substantially in recent years, most customers choose to stay and gobble up any new product the company throws at them.

Recent quarterly results confirm this, showing a massive increase in iPhone revenue, at this point accounting for 48.5% of Apple’s total revenue (source: Apple).

Now, the next big transition in the cell phone industry is the move from 4G to 5G. It’s still in the early phases of growth, but Apple’s customers are known to be fans of the latest tech.

Thus, it’s very likely that the majority of customers are wanting to upgrade to 5G in the upcoming years, which means they’ll likely upgrade to a 5G compatible iPhone even if there are cheaper options available on the market.

Apple continuously raising prices on their flagship models over time doesn’t seem to scare away their loyal client base, so the shift towards 5G likely won’t be any different. That’s why we think the next round of sales for Apple is not only ‘secured’, but likely will continue to strengthen further in the years to come.

As a small ‘cherry on top’, in 2012, after 16 years of halting its original dividend, Apple started paying dividends again. It’s only a meager 0.6%, but better than nothing.

In conclusion, despite Apple trading at all-time highs, we do think the company and stock have more to give and thus rate it a solid buy and investment opportunity long-term.

Technical Analysis

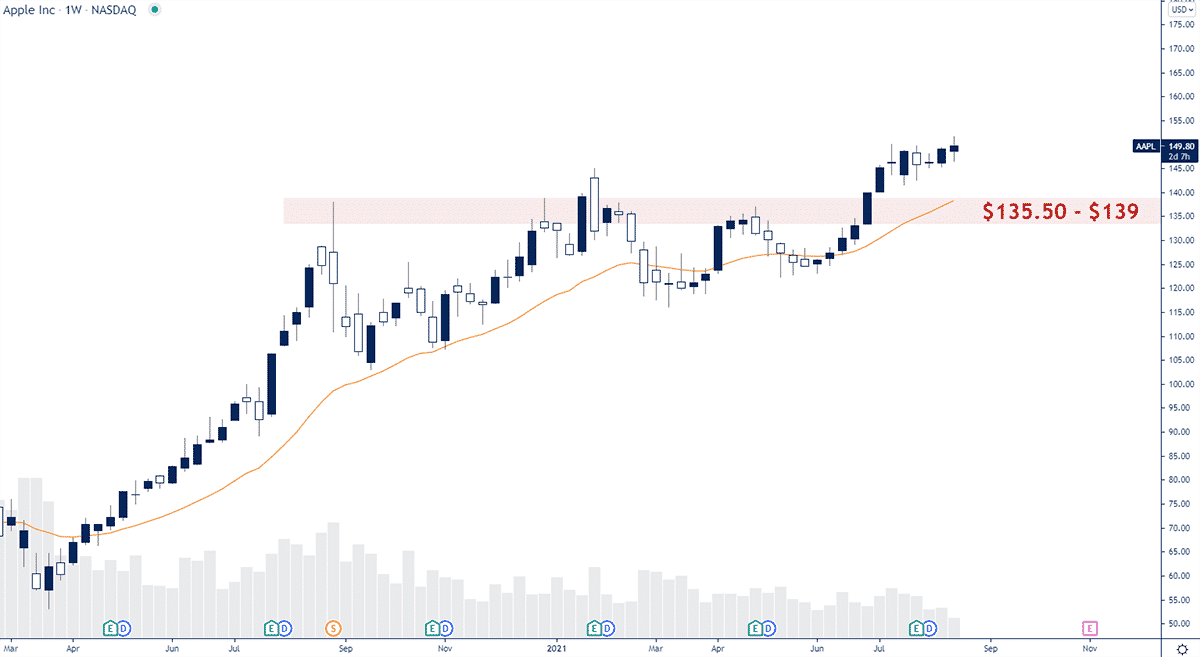

Since then, bulls have been able to hold price above this key resistance zone, which now should act as support on pullbacks, which in our opinion is a good area to look for entry locations.

Option Positioning

Currently there are 4.7M calls and 3.6M puts with about 29% of those options expiring this Friday. We feel this should put some mild pressure on AAPL hence would like to buy closer to $140.

FULL DISCLOSURE: Chris Capre currently has no stock or option position in AAPL, but he does have pending orders on AAPL. If you’d like to learn more about Chris’s trades and positions, you can get access via the Trading Masterclass where he shares his live trades, further investment ideas and daily market analysis.