“One man’s loss is another man’s profit”. This couldn’t be more true for MarineMax (NYSE: HZO). Whilst the pandemic wreaked havoc on the global travel industry, companies focused on domestic recreational activities saw a massive boost.

MarineMax is the worlds largest recreational boat & yacht seller which has seen both their revenue and net income skyrocket during the pandemic.

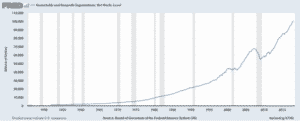

However, the pandemic is not the only contributing factor. Thanks to the booming stock/housing market and low interest rates, household net worth across the globe has soared to new all-time highs in the last 10 years.

One company benefitting from this massive increase in wealth (and inequality growth) is MarineMax as high-net worth households like to invest in (and show off) luxury products.

Besides selling boats, a business that fluctuates based on seasonality, the company also operates 30+ marinas, providing charter services, storage and more which gives the company a reliable and steady stream of cash flow.

Financially the company is delivering one record-breaking report after the other.

Below are a few key points from MarineMax’s recent financial report:

- Record June Quarter Revenue Grows 34% to Almost $667 Million

- Same-Store Sales Grew 6% on Top of 37% in the Prior Year

- Gross Margin Expands to Nearly 31% – A Record For The June Quarter

- Record June Quarter Diluted EPS Increases 64% to $2.59

And if you look at Q1 and Q2 reports, you’ll should notice the word “record” showing up frequently across the board.

Despite a strong bull-run in the stock in the last 1,5 years, thanks to the record-breaking increase in revenue and a 30% drop in the stock price recently, the price to earnings ratio has been pushed back below 8, which in today’s market can be considered cheap (Amazon for example is trading at a P/E ratio of 60).

Overall, we like HZO as a potential investment and think that there is more upside potential for the stock which the market hasn’t been priced in yet by the market.

Technical Analysis

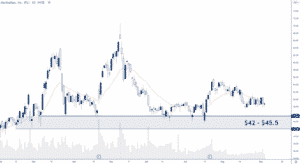

The stock topped out at around $70 in May, following a 750+% bull run in 14 months. Since then, the stock has sold off 30% and is currently trading at around $49.

Price is trading close to $42 and $45.5 which price action indicates is a strong area of support for this stock. We think that potential pullbacks into this support zone can offer bulls looking to acquire shares of MarineMax a good opportunity to do so.

Option Positioning

This is and incredibly low options volume stock with only 6K options floating out there. Hence we take option data with a grain of salt when viewing them with these numbers.

But we think support will come in around the low 40’s.

FULL DISCLOSURE: Chris Capre currently has no stock or option position in HZO. If you’d like to learn more about Chris’s trades and positions, you can get access via the Trading Masterclass where he shares his live trades, further investment ideas and daily market analysis.