There are many sectors that have had outperformance this year. Examples are energy, tech and home improvement stocks.

One sector you should seriously consider exposure to in your investing portfolio is ecommerce. Not only is the sector growing at a rapid pace, but the business model of many of the companies makes them very resilient as they quickly can adapt their organization to changing market conditions.

One big player in this sector is ETSY (Nasdaq: ETSY). If you’ve been living under a rock and haven’t heard of ETSY yet, ETSY is an ecommerce platform where ordinary people like you and me can sell handmade or vintage items and craft supplies.

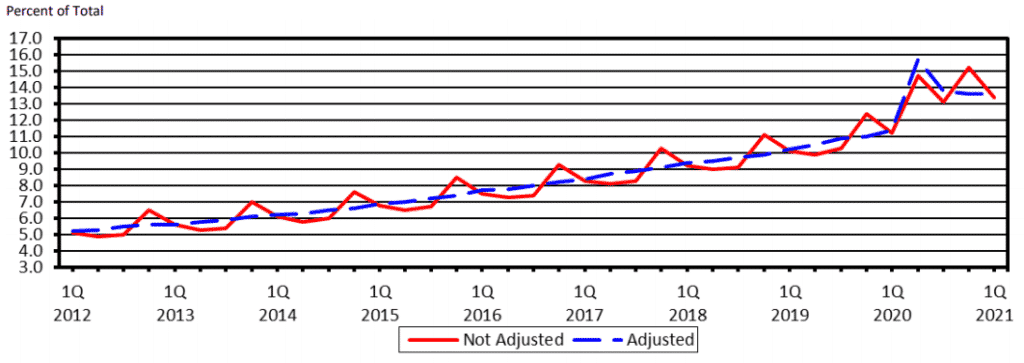

Even before the start of the pandemic, ecommerce was on the rise. But the pandemic was like pouring gasoline on a fire that has catapulted the sector to new highs at a phenomenal growth rate.

In the US alone, ecommerce sales reached a massive $196.66 billion, which equals a 39% year-on-year growth compared to Q1 2020

(source: U.S. Department of Commerce data)

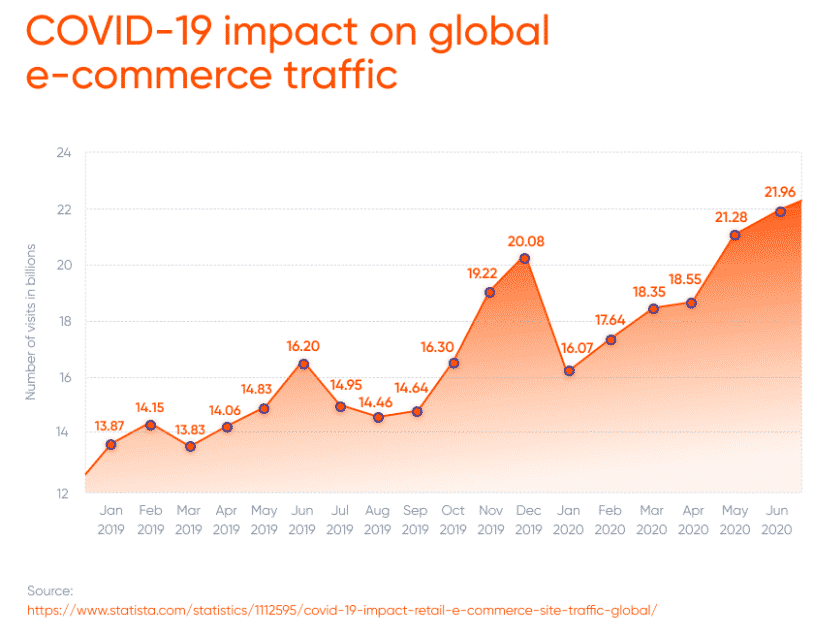

The growth is not limited to US and global ecommerce traffic has been in a steady uptrend for many years, with an impressive increase of 58.33% since January 2019 alone.

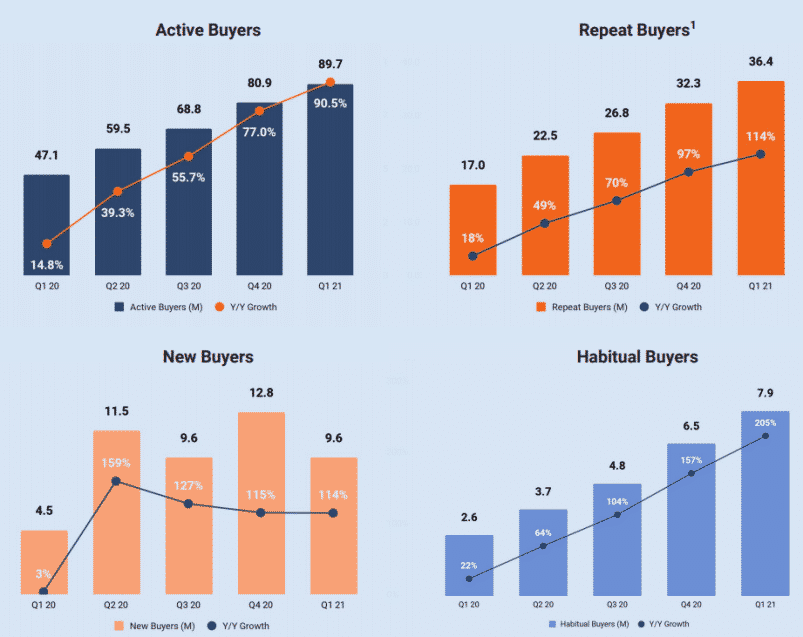

Obviously, the growth of ecommerce has had an incredibly positive impact on Etsy’s business as well.

Since the start of the pandemic, ETSY has seen a strong inflow of new buyers which is great news for the company. Between Q1 2020 and Q1 2021, new buyers increased by 114%, active buyers by 90.5%, repeat buyers by 114% and habitual buyers 205%. The statistics of repeated buyers and habitual buyers is particularly impressive as those numbers are a strong reflection of customer satisfaction.

(source:)

With other words, ETSY customers are more than happy to come back often to make new purchases. New sales are good, recurring sales are GREAT as that ensures a consistent cash flow for the company.

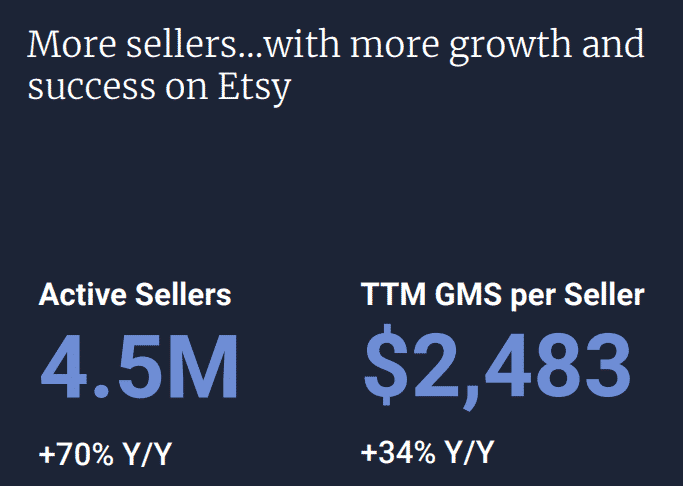

Not only does the number of buyers go up, but so does the number of sellers with an impressive 70% year-over-year growth between Q1 2020 and Q1 2021, ensuring a strong influx of new products to Etsy’s platform, which in turn likely will generate even more sales long-term.

(source:)

Thus, from a fundamental and sentiment standpoint, we think that ETSY is in a strong position to take further advantage of the growth in the ecommerce sector, making it a strong candidate for investors looking for long-term investment opportunities.

Technical Analysis

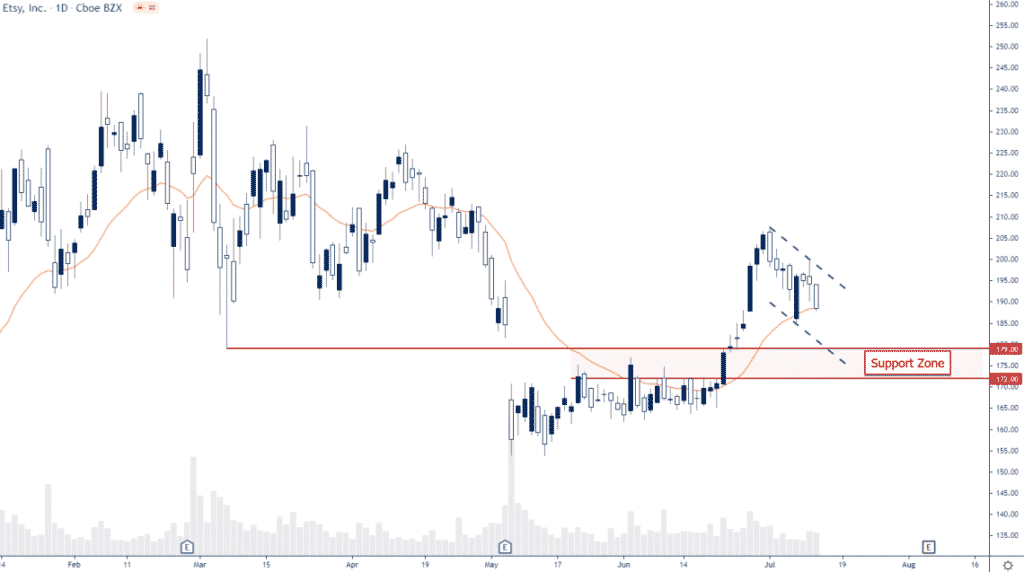

On the 28th of June ETSY shares rose sharply on news that the company was acquiring the “Brazilian version of Etsy” knows as Elo7 for $217 million.

This bullish impulsive move in the price action cleared a key resistance that had held for more than a month changing the short-term bias to a more bullish stance. The pullback since the surge is slower than the buying preceding it, indicating that the order flow is imbalanced to the buy side.

Based on this price action, we think the support zone between $172 and $179 is a logical area to look for potential entry locations.

Option Positioning

Looking at option positioning, ETSY has about 90K calls and 100K puts with 34% of those options rolling off this Friday. This would suggest a short term pullback and potential resistance around $200, which aligns with the current price action and technical analysis.

FULL DISCLOSURE: Chris Capre currently has no stock or option position in Etsy, but he does have pending buy limit orders on ETSY. If you’d like to learn more about Chris’s trades/positions, you can get access via the Trading Masterclass where he shares his live trades, further investment ideas and daily market analysis.