One lesson the stock market has consistently hammered on us is that when something looks too good to be true, you’ll find a stinker nine times out of ten if you dig deep enough.

But that’s nine times out of ten. What happens to the remaining one?

Well, Enterprise Products Partners (NYSE: EPD) is that one. There aren’t many stinkers that can effectively ruin this stock or income investors.

Source: Zukiman Mohamad

One of the greatest strengths of Enterprise Products Partners is its diversity. The company provides various midstream services of natural gas, natural gas liquids (NGLs), petrochemicals, crude oil, and petrochemicals. Although the bulk of its income comes from NGL, its diversification into petrochemicals and crude oil has proven to be business-smart.

Perhaps, the most attractive aspect of EPD is its high and safe dividend yield of 7.4%. And not only is this dividend yield sumptuous, but the company also has a good habit of increasing dividend-per-share annually for 23 years.

Thanks to the company’s midstream service diversity, cash flows have been reliable enough to keep the business running while still paying 86% of earnings to unitholders. Even then, the company has $7.3 billion in free cash flow.

Concerning growth potentials, Enterprise Products Partners isn’t the most exciting. However, the future is by no means bleak too. EPD estimates that 3 billion people on earth still live in energy poverty. But if you, just like us, think that’s a long shot, here’s another: Navitas Midstream, the company’s recent acquisition, is expected to bolster EPD’s cash flows going forward.

The icing on the cake for EPD is how it’s inexpensively priced compared to its industry and the US market at large. The company boasts a PE ratio of 11.9x, which trails the US Oil and Gas industry PE ratio of 15.8x.

Technical Analysis

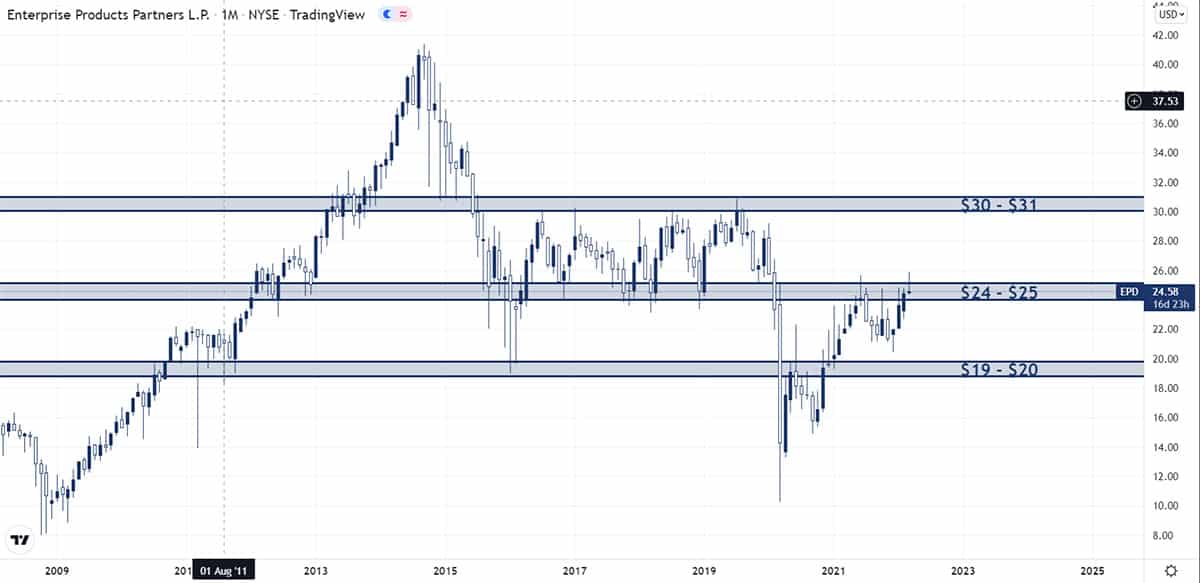

A high dividend yield is not the only thing EPD unitholders have to be glad about. A look at the EPD stock chart reveals how the stock is making a gradual recovery from the great dip of 2020. Having dipped to as low as $10, the stock has risen by 140% to its current price.

The level where the stock finds itself now is the more interesting thing. The $24 – $25 resistance level hovers firmly over the price. Whether the stock breaks this level after attempting and failing twice since last year is anyone’s guess.

If the stock fails to break this level, the $19 – $20 level awaits. But if the breakout is successful, the stock has about 20% upside before it hits the next significant resistance level of $30 – $31.

Whatever happens, though, the stock is still about half of its all-time high of $41. So, there’s still a lot of space for the stock to grow.