Are telemedicine stocks here to stay, or going away?

Telemedicine experienced strong growth leading up to 2020. Covid-19 gave the sector afterburners. Telemedicine companies saw their stock price multiply many times over from the start of the pandemic.

Now vaccines are rolling out and restrictions are being lifted. It’s worth asking if telemedicine companies will continue to grow at the same pace, or if it’s a bubble about to pop.

I think it’s a mix of both. Let me explain why.

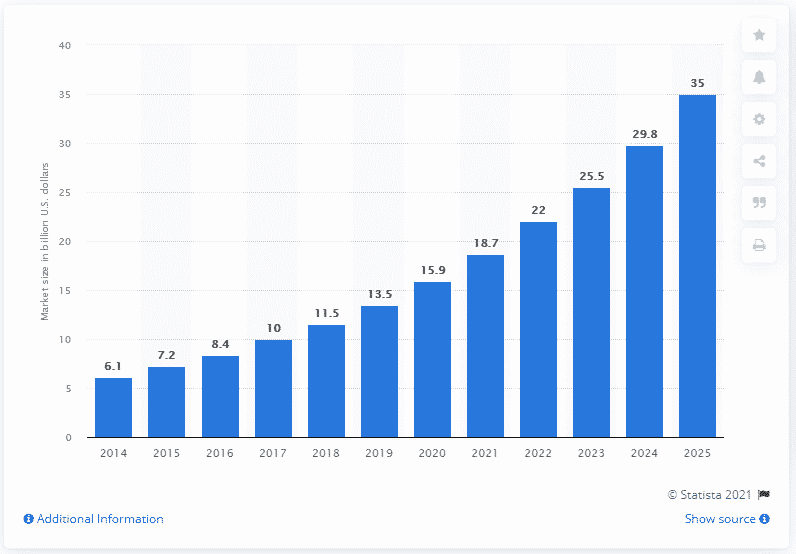

Prior to the pandemic, the global telehealth market was already growing 19% on a year-on-year basis. Forecasts expected growth to be even faster in the years to come. The estimated virtual care market in the US alone is $250 billion.

Technologically advanced countries like Finland and Sweden have also been using telemedicine apps and services for many years. It’s a disruptive service and technology that is happening globally.

(source: statista.com)

Telemedicine is used for simple tasks. This includes asking a medical professional for advice, or getting a new drug prescription.

To put this into perspective, imagine you need a new prescription. Generally you need to visit the doctor’s office to do this, which means travel to/from the doctor’s office for 30-60 minutes, plus an additional 30 minutes in the waiting room. Or you could just pick up your phone from the comfort of your own home, have a 5-minute video-call with your doctor, and get the prescription.

I think we all would prefer the latter. This goes to show why the growth forecast shared above isn’t unrealistic in my opinion.

Teladoc (NYSE: TDOC) is pushing to become a ‘whole person care’ service, primarily focusing on providing virtual primary care. This is something they want to achieve via “Primary 360”.

One example of a service included in this program is the growing ‘hospital at home’ space. This extends patient monitoring post discharge from the hospital. A device continuously monitors the patients’ vitals and sends the information directly to the hospital.

Most companies only focus on the product/service right in front of them, whilst Teladoc looks way beyond this.

We think Teladoc has a bright future. It’s an ideal candidate for investors looking to add telehealth to their portfolio.

Technical Analysis

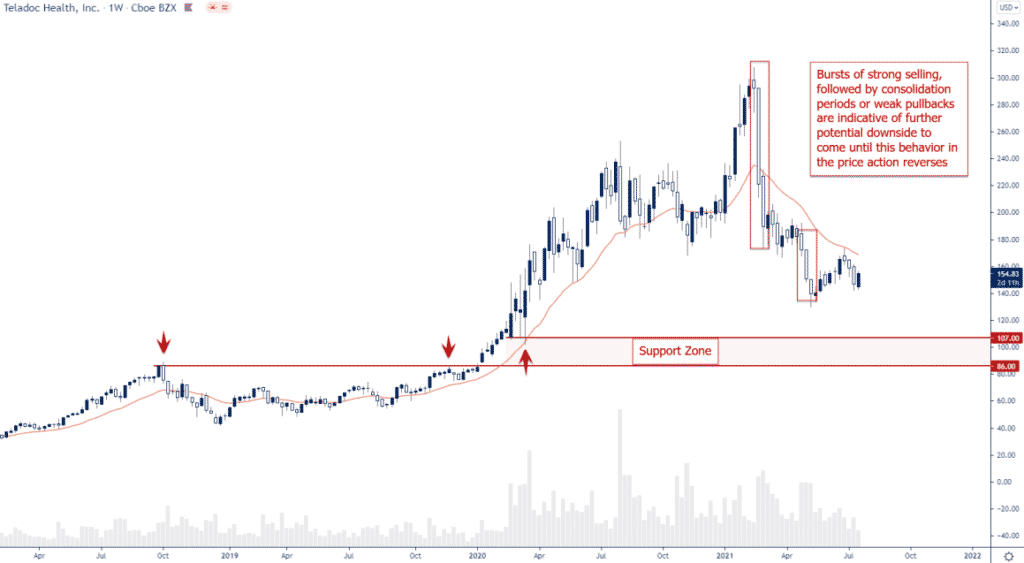

Since the all-time-high of $308 in mid-February this year Teledoc (NYSE: TDOC) has declined 50% (at the time of writing). Looking at the price action, there is likely more downside to come.

As you can see in the chart above, the periods of selling are strong whilst the consolidations/pullbacks are very weak. From a price action perspective this is highly indicative of the order flow in this stock still being heavily skewed towards the sell-side.

Therefore, we do not think that Teledoc is a good buy at the current price. This is unless we see a strong short-term reversal in the price action from bearish to bullish, which for now clearly isn’t the case.

If the stock continuous to slide, there is a strong area of support waiting between $86 and $107. We think this makes for a potential area for long-term investors to investigate.

Option Positioning

Currently the market is put heavy. There are 200K puts vs 150K calls. ST we think resistance comes in around $155 with support levels coming in between $86-$107.

FULL DISCLOSURE: Chris Capre currently has no stock or option position in TDOC, but he does have pending limit orders on TDOC. If you’d like to learn more about Chris’s trades and positions, you can get access via the Trading Masterclass where he shares his live trades, further investment ideas and daily market analysis.