Not all dips are worth buying, especially for biotech stocks that don’t seem like they may ever make their way up again. But we have substantial reasons to believe the Vertex Pharmaceuticals (Nasdaq: VRTX) stock is far from being a debbie-downer.

Founded in 1989, Vertex Pharmaceuticals commits itself to the research, development, and manufacture of drugs to treat serious illnesses, such as cystic fibrosis (CF).

(Image Source: Chokniti Khongchum)

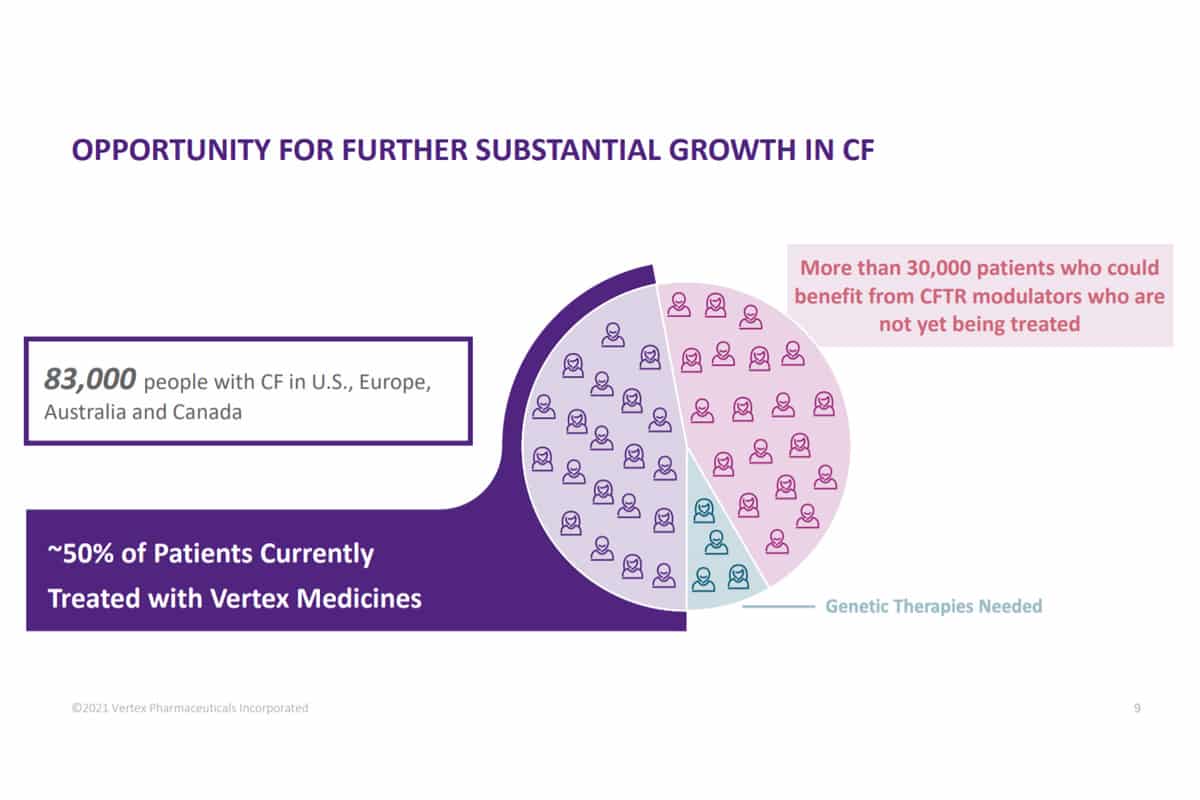

Growth should not be a problem for Vertex, especially with its CFTR modulators, Trikafta and Kaftrio. About 83,000 people in Australia, Canada, Europe, and the US have CF. Vertex’s CFTR modulators are being used to treat about half of the number. There are still There are over 30,000 patients who can be treated by the drugs but are yet to be treated. The stock gets even more attractive when you consider the fact that there are no major competitors for Vertex that might take some of the company’s potential CF patients.

(Image Source: Vertex Pharmaceuticals)

Another potential growth opportunity for Vertex is in cell and genetic therapies that could spell an end to sickle cell disease and beta-thalassemia. The company is currently testing its medicine, CTX001, and may file for approval within the next 2 years. If the company is successful and pushes the drug to the market, there are over 150,000 potential patients in Europe and the US.

Vertex has also had reasons to smile about its revenue growth. The company gathered $1.8 billion in revenues after Q2 of FY 21. This was an 18% growth from what it made in the same period of last year.

All things considered, the future looks bright for Vertex Pharmaceuticals.

Technical Analysis

Vertex stock soared to an all-time high of $299.21 in July 2020. It has since fallen by over 40%. But there’s every reason to believe we’re only seeing a corrective pullback to the base trendline and nothing more.

The price is well above the base trendline at the moment and may well continue its dip to that level. However, the price will have to go past two support levels ($160.93 – $166.87 and $135.20 – $140.47) to do that. Any of these two support levels could serve as a viable level from which the price charges out of the minor downtrend it has embarked on.

Options Positioning

The options trading market is showing about 43K calls and 35K puts, so a mild stock in terms of option volume and positioning. I’m seeing about 55% of the options rolling off this Friday, which could put pressure on the stock short term.

The first pullback support zone mentioned between $160-$166 will be our first level to consider longs.

FULL DISCLOSURE: Chris Capre currently has no stock or option position in VRTX. If you’d like to learn more about Chris’s trades and positions, you can get access via the Trading Masterclass where he shares his live trades, further investment ideas and daily market analysis.