Cloud based software solutions may not be screaming “growth” like other industries in the tech space are. But they may be the hottest things in the coming decade as interconnectivity reaches its peak. The best time to get in on stocks in this industry is now. And you can start with Veeva Systems Inc. (NYSE: VEEV).

Source: PhotoMix Company

Veeva offers cloud-based software solutions that help companies improve the efficiencies of their operations. The company currently focuses on client companies in the life sciences industry, a niche market where Veeva is without major competitors. It’s two major products are Veeva Commercial Cloud and Veeva Vault.

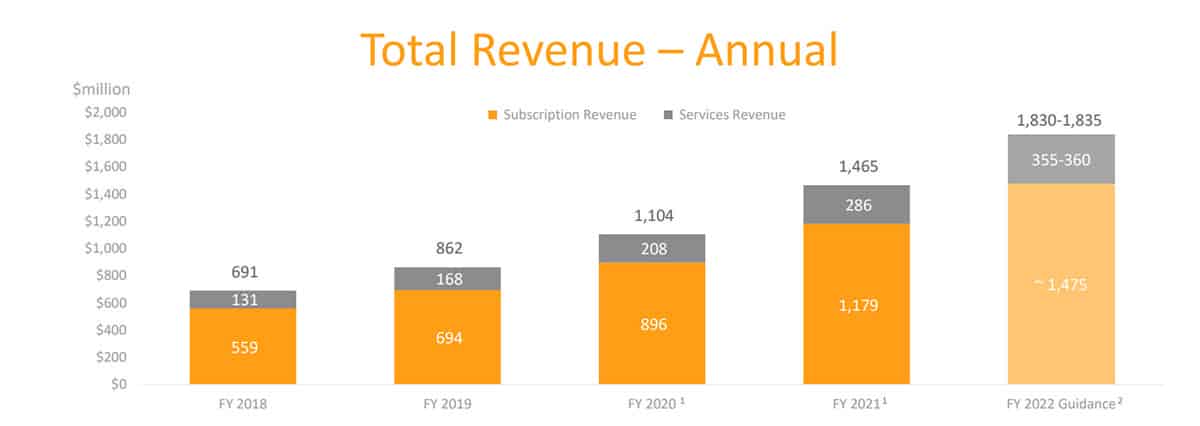

Veeva has enjoyed enviable success in the past years, with both GAAP and non-GAAP growth metrics trending upwards. The company offers its cloud based products to customers on a subscription basis which raked in about $1.18 billion in FY ‘21 (a 31.6% increase from the previous year). Service revenue climbed by 37.5% to $208 million in the same time.

(Source: Veeva)

And in Q2 FY ‘22, the company has already secured a 29% revenue increase from where it was a year ago. Being the dominating force in its niche, it is easy for Veeva to build on its success for the coming years.

Technical Analysis

For a few months now, VEEV has been in consolidation as it returns to form a trendline with a point from over a year ago. In the past week, the stock returned to this trendline and has bounced up from it. The stock approaches the $328 – $340 resistance level, where it will attempt a breakout. If the breakout is successful, it’s an open sky for the stock. A new all-time high will be set, and new resistance levels will be set.

On the flip side, there’s the possibility that the stock fails to break out of the resistance level but has enough momentum to infiltrate the underlying trendline. If this happens, the $173.5 – $186.5 support level would be a good place for the price to rally for another bullish push.

Option Positioning

Currently there are 26K calls and about 26K puts, so not a huge option volume stock in terms of positioning. Our first layer of option support comes in around the recent dip lows around $280.

FULL DISCLOSURE: Chris Capre currently has no stock or option position in $VEEV. If you’d like to learn more about Chris’s trades and positions, you can get access via the Trading Masterclass where he shares his live trades, further investment ideas and daily market analysis.