Shareholders of Wix.com Limited (Nasdaq: WIX) can’t say they had a glorious year in 2021. The stock had a three-week surge that took the stock to an all-time high of $361 in February. But for the rest of the year, the narrative was bearish. It’s a new year (Happy New Year, by the way), and the question on many shareholders’ minds is this: Is 2022 the year for Wix to soar?

Source: Monoar Rahman

While we can’t answer that question because we don’t know what will be, we can categorically tell you that the fundamentals of the Wix stock make a strong case.

Wix allows anyone to easily design professional-looking websites by simply dragging and dropping items using customizable templates. Customers can then keep access to their websites by paying monthly/annual subscriptions to Wix.

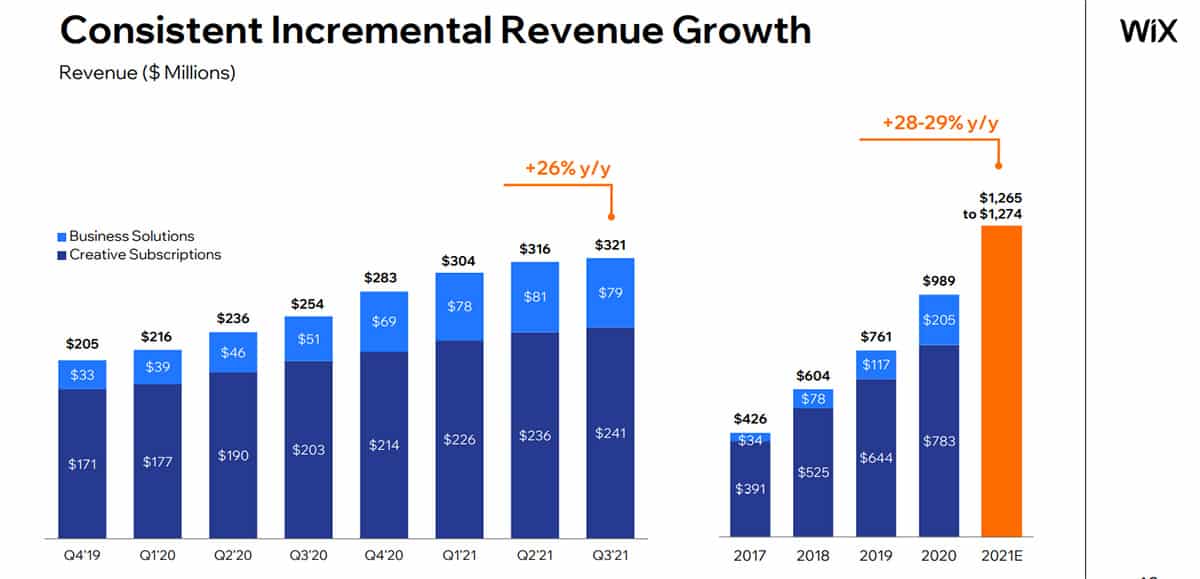

While the company has other departments, such as eCommerce and online payments, the subscription (creative subscription, as Wix calls it) remains its biggest source of income, generating 66% of its total revenue in Q3 FY 21. The revenues for Creative Subscriptions also increased by 18% year on year.

Stiff competition is an understatement for what Wix faces from the likes of Shopify, WordPress, Squarespace, and Weebly. But with innovations that offer customized services to restaurants, events, bookings, fitness, hotels, and stores, Wix stands a reasonable chance of remaining robust in the space. And so far, revenues from these Business Solutions increased by 54% year on year in the recent quarter.

In addition, the website builder claims to have a potential and future collection of up $15.4 billion in the next 10 years, which is a healthy load of cash for expenditures.

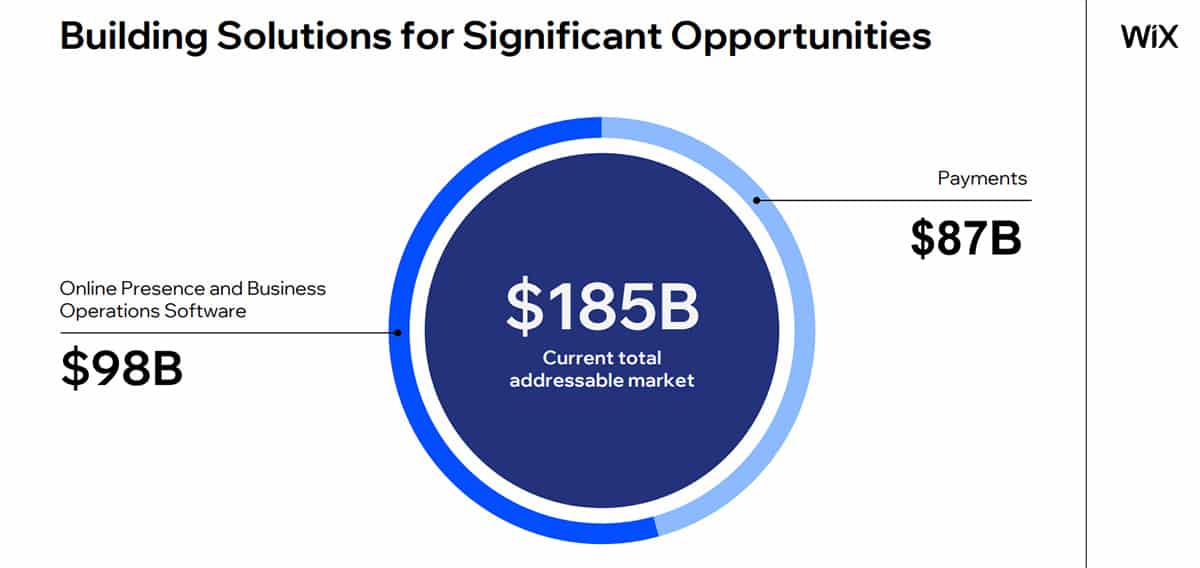

With everything the company has in its hands, Wix estimates its total addressable market to be $185 billion. And it hopes to ride on its 113% net revenue retention to reach that goal.

Technical Analysis

The WIX stock has been aggressively chased down by the bears, despite some fickle challenges by the bulls sometime last year. As we speak, the bears currently have it on the stock, having driven the stock down by 56% from its all-time high.

However, investors may be excited that the price of the stock now rests atop the $149 – $161 support level which looks to have temporarily stalled the dip. But only time will tell how long this excitement will last, as there still exists the $70 – $83 support level at the level and no bullish pattern is forming.

Even if the stock bounces off the support level back up, the stock still has to break out of two descending trendlines before the bulls can have any real hope.

For new investors, however, this dip is good news. Wix has strong fundamentals and powerful growth potential.