Sea Limited (NYSE: SE) is a Southeast Asian company that offers gaming, e-commerce, and financial services to its customers. Garena, its game-publishing department, owns one Free Fire, one of the highest-grossing mobile games in the region.

Source: Sam Lion

Sea, As it Stands

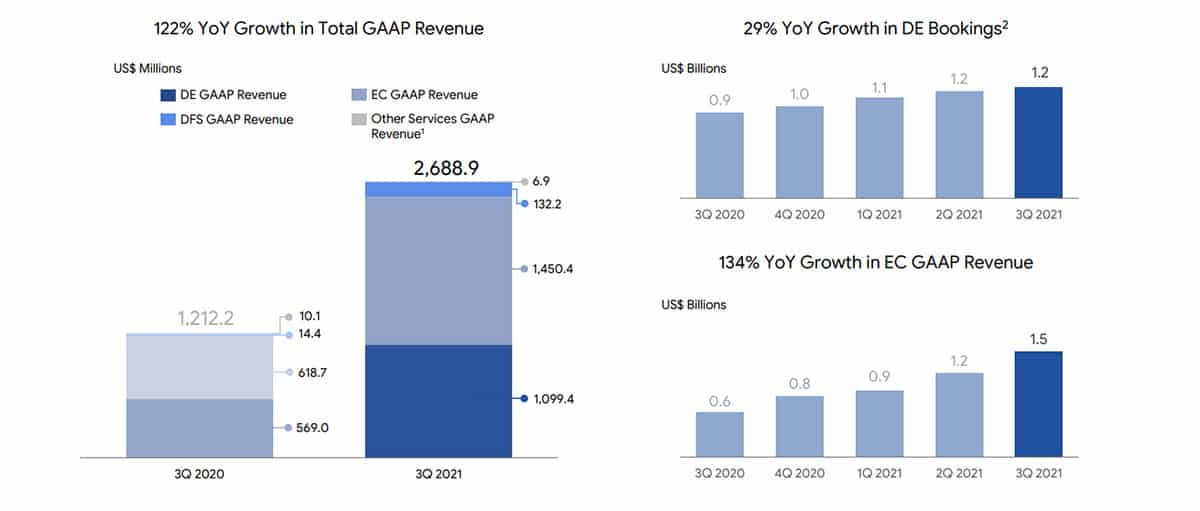

Sea Limited enjoyed a triple-digit GAAP revenue increase by 122% year-on-year according to its latest Q3 FY 21 report. The company has its three departments to thank for that.

Source: Sea Limited

Garena saw a 43% year-on-year rise in quarterly paying users. The company’s eCommerce department, Shopee, increased its gross orders by 123% to 1.7 billion. And its financial service, SeaMoney, had its total payment volume increase by 111% from what it was in Q3 2020.

Historic and Future Growth

Growth seems to be no problem for Sea Limited if history is anything to go by. The company started its business in Singapore, but it has since then expanded to the rest of Southeast Asia. It also has a presence surrounding countries, such as India and Taiwan, and some of Latin America.

Going forward, the future looks even brighter. The internet economy of Southeast Asia would be three times in 2025 of what it was in 2019, according to the e-Conomy SEA report. And with Sea Limited being one of the leaders in the internet game in the region, it stands to reap from this growth.

The Risks

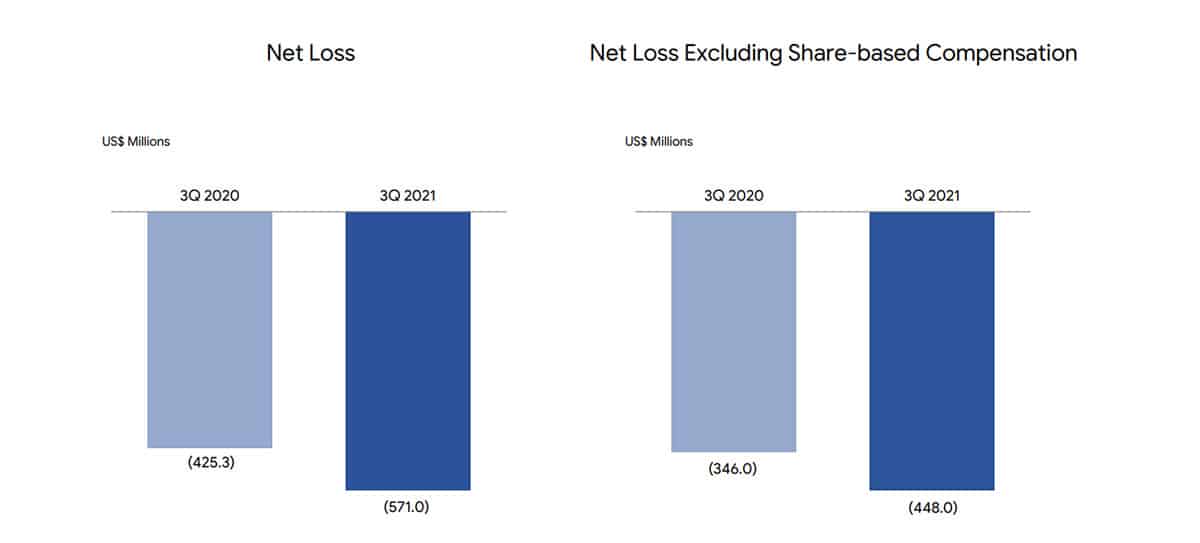

The first potential red flag an investor might encounter when looking into this SE stock is that the company isn’t profitable, accruing even more loss in the last quarter year-on-year. According to Sea, all the gains from the company are being re-invested back into building the company.

Source: Sea Limited

The company’s over-reliance on Garena could also be a problem in the future. And it is the proceeds from this game that bankrolls about a substantial part of the company’s other expenditures. Recently, the earnings from the game have started to stagnate, and if the company is unable to come up with another high-performing game, it may suffer.

The only upside here is that Sea keeps modest cash and cash equivalents of $11.8 billion. So, even if the Garena falls out of favor, the company still has some cash to run its business for a while. There is just no telling how long this would last.

Technical Analysis

SE has been on a free fall since November without as much as a temporary bullish correction on the weekly chart. As we speak, it is down by 43% from its year-to-date and all-time high peak of over $370 to the $195 – $205 support level.

So, is this the best time to buy SE?

For investors who have the guts to hold a non-profitable company long-term, buying SE may not be a bad idea. However, if you’re in for the short-term, we believe a better/lower price is worth waiting for. Or at least until we have enough reason to believe the stock has bottomed out and is about turn bullish.