The global adoption of e-sports has taken time, but at this point it should be out of the question that e-sports is here to stay and very likely will enjoy massive growth over years to come. Global revenue is expected to increase 15% and reach more than $1 billion in 2021.

One company, that only has scratched the surface in this field so far is the skill-based company Skillz (NYSE: SKLZ).

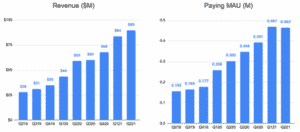

Skillz business is growing rapidly with a 52% revenue growth year-over-year in Q2 with paying monthly active users (MAU) being up 53%.

(Source: Skillz Q2-21 Shareholder Letter)

Also, in August, Skillz invested $50 million for a small stake in Exit Games which opens up the possibility for the company to expand their business into games such as FPS (first person shooters) and battle royale which are fast growing genres.

Now, despite the fast-growth and massive future potential of the esports market, investors are clearly realizing (and pricing in) that Skillz is facing strong headwinds on top of the companies extremely aggressive marketing strategy.

For example, the company did spend 111% of its Q1-revenue on marketing, yes, you read that correctly. This is a lot even for a company focusing on aggressive growth, almost bordering on desperation. So far, this marketing strategy isn’t working out as planned for the company, i.e., it’s not bringing in the expected number of new customers.

Thus, for the bearish trend to reverse into a bullish one, the management of Skillz clearly must come up with a new customer-acquisition strategy. This is clearly something investors also are aware of, which is likely why the stock has given back 3/4 of its gains in the last 6 months.

But there is light in the tunnel such as the company focusing on and investing in new content and data science, the partnership with Exit Games and the acquisition of Aarki which is an AI-enabled mobile marketing platform that should help to bring marketing costs down significantly over time.

In conclusion, we think Skillz still has a lot to prove in terms of stability and how to turn the business profitable before becoming a solid buy. However, with the stock being back at IPO levels after taking a massive beating, aggressive investors might find that the potential reward, if the company can get things right, might outweigh the risk and justify a small long-term investment. In other words, we think Skillz is a potential high-risk/high-reward play, but not a stock we’d recommend for conservative investors, at least not yet.

Technical Analysis

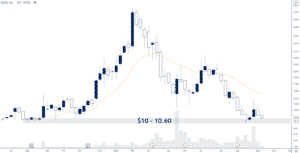

The stock currently is down more than 75% since its all-time-high in February this year which is a massive drop and reality-check. Price is now trading slightly above the IPO levels which is the price range the last strong bull-run emerged from.

The stock bounced +20% in the end of August from this price range confirming that there is a good amount of unrealized bullish order flow waiting in this area.

For investors interested in acquiring shares of Skillz, we do think this support between $10-$10.60 offers a good price range to look for buying opportunities.

Option Positioning

Currently there are about 245K calls and 145K puts, so a call heavy option market. 35% of the gamma is rolling off this Friday, so should create some headwinds till then. Option positioning suggests $10 could act as a decent support.

FULL DISCLOSURE: Chris Capre currently has no stock or option position in SKLZ. If you’d like to learn more about Chris’s trades and positions, you can get access via the Trading Masterclass where he shares his live trades, further investment ideas and daily market analysis.