Change from analog to digital transactions has been rapid in the last decade and COVID-19 only accelerated this move.

One company profiting heavily from this transition is Visa (NYSE: V). They already have a massive customer base, which means they will automatically be part of the accelerated growth (and revenue) in the move from cash to digital. And the proof is in the pudding.

In the last 10 years, Visa stock price has increased by a mind-blowing +1000%. In the last 3 years alone, Visa has reported a profit margin of close to 50% which means that for every dollar of sales generated, the company has a net income of $0.50!

Compared to money-making machines like Apple or Google, they both ‘only’ have a profit margin of roughly 20%, it’s not hard to see why Visa’s stock has been skyrocketing for years on end.

A lot must go wrong for a company like Visa to get in trouble. Thus, for investors looking for stable growth over time, we think that a stock like Visa would make a good addition to a long-term portfolio.

Oh and we forgot to mention, Visa sports a respectable dividend of .51%.

Technical Analysis

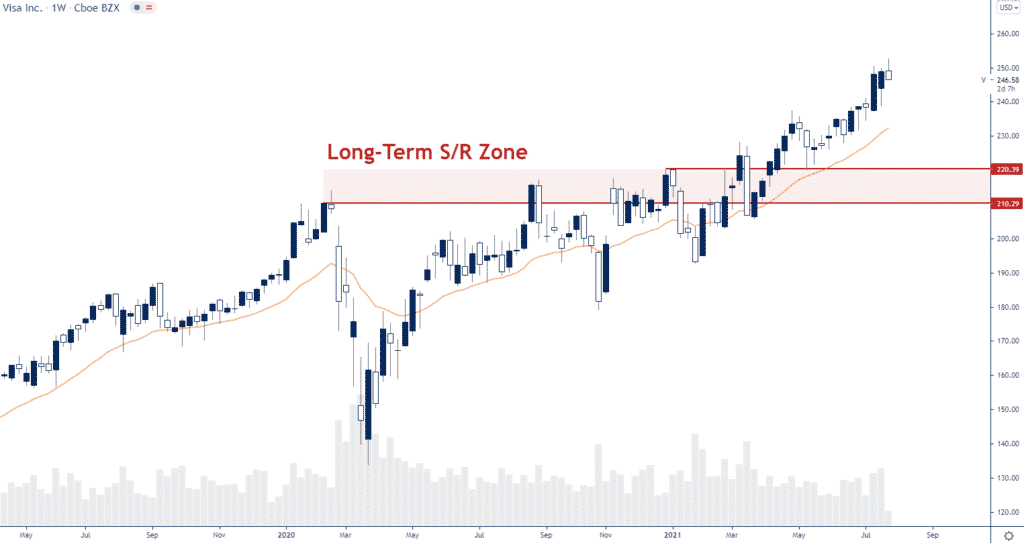

Long-term trends rarely are a straight line though, and periodically, stronger pullbacks are to be expected. Investors looking to start building a long position in Visa thus likely do best in being patient and wait for a solid correction in the stock.

Based on the long-term price action, we think the key support zone between $210 – $220 is a really good price range to look for potential buying opportunities with more aggressive traders looking for a price in the low $240’s.

Option Positioning

Currently there are about 325K calls and 252K puts in the option market universe, so call heavy. The largest delta strike is not till Jan 2022, and is above the current price, which favors a solid outlook for the rest of the year.

FULL DISCLOSURE: Chris Capre currently has no stock or option position in V, but he does have pending limit orders on V. If you’d like to learn more about Chris’s trades and positions, you can get access via the Trading Masterclass where he shares his live trades, further investment ideas and daily market analysis.