The journey has been one fraught with literal ups and downs for Upstart Holdings, Inc. (Nasdaq: UPST). But we believe it’s a smart growth stock to have in your portfolio.

Source: Andrea Piacquadio

Here’s What Happened

The stock had its IPO late last year. It then soared by a thumping 900% to a peak in October. But it has lost about half of what it gained in a month. This dip was fueled by headwinds in the form of a major investment bank, Jefferies, lowering their ratings on the stock. And more ironically, an exceedingly strong expectation for the coming quarter.

Why This Matters

The Artificial Intelligence lending platform gathers loan demands from its customers and matches them to bank partners that’ll give out the loans. Since its IPO in December, Upstart has soared and hardly looked back. Well, until October, anyway.

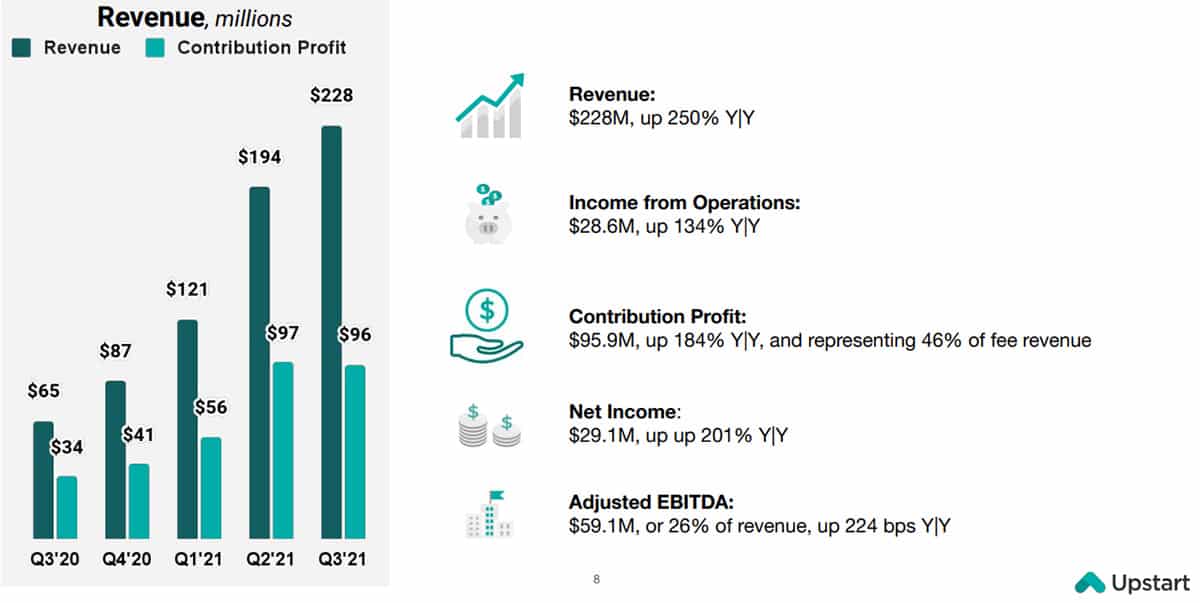

Although the company recorded a year-on-year increase of 250% in revenue to $228 million in Q3 FY 21, some investors still believed it could have done better. And this underperformance might have taken the ultra-shine off.

Source: Upstart

With these financial results, it is obvious that there’s something worth watching out for in Upstart Holdings. And this dip may only be a slight inconvenience when you look back to it many years from now.

What’s Next?

Despite the temporary dip the UPST stock is experiencing, its room for growth is still massive. First off, its market cap of just $500 million leaves a lot more money to be made. Transaction volume on the platform also more than tripled to 363,000 transactions over the last year.

Source: Upstart

In spite of these, the company is not taking a break. The company acquired an auto loan software company to target that niche which has a market of $672 billion. UPST also claimed to have its eyes set on mortgage loans by 2022, exposing the company to an enormous market of $4.5 trillion.

Technical Analysis

It only took a month for UPST to lose everything it gathered in 8 months. But then, that’s what dips usually look like. Despite this emphatic dip, however, the stock is still in an uptrend, as it remains above an ascending trendline.

Right at the top of the reversal, the stock formed a Head-and-Shoulders pattern that sentenced the price to a 35% drop. The stock has more or less served this sentence, and it currently hovers close to the $178 – $191 support level. And coincidentally, the ascending trendline just happens to be close by.

With these, it looks like UPST may rally at this support/ ascending trendline level and challenge for another bullish run. If the stock defies the support level and the trendline, this confirms a further dip to the lower $103 – $114 support level.

But from wherever, we hold a bullish sentiment on Upstart Holdings.

Option Positioning

Currently there are about 116K calls and 81K put options. Of those options, about 20% are expiring on the Dec. 17 op-ex. So there is no short term pressure in terms of monetization going forward. But there is likely put protection increasing during this sell-off which may have helped exacerbate this drop.

TBH, I think UPST had overshot over the last few months and am happy to see it back down on Earth. We’re not ready to buy yet, but we’re getting there.

FULL DISCLOSURE: Chris Capre currently has no positions in $UPSST. If you’d like to learn more about Chris’s trades and positions, you can get access via the Trading Masterclass where he shares his live trades, further investment ideas and daily market analysis.